What is a Corporation Tax Loan?

Corporation tax is a tax on the profits earned by businesses in the UK. It’s due 9 months and 1 day after your business year and must be paid in a single payment to HMRC. But corporation tax loans allow you to spread the cost over monthly terms, freeing up your cash reserves to grow your business in more ways.

The Benefits

Boost Cash Flow

Get working capital for day-to-day expenses.

How do Corporation Tax Loans Work?

It’s very straightforward! We simply arrange the money for you to pay your tax bill and you repay in monthly instalments. It’s the same process with our VAT loans. There are no hidden fees, it’s just a flexible stopgap so your business keeps moving without disruption.

If corporation tax isn’t paid on time, you could face penalties and charges. A tax loan allows you to pay the bill on time and stress-free. Everyone’s a winner.

Business Loan Calculator

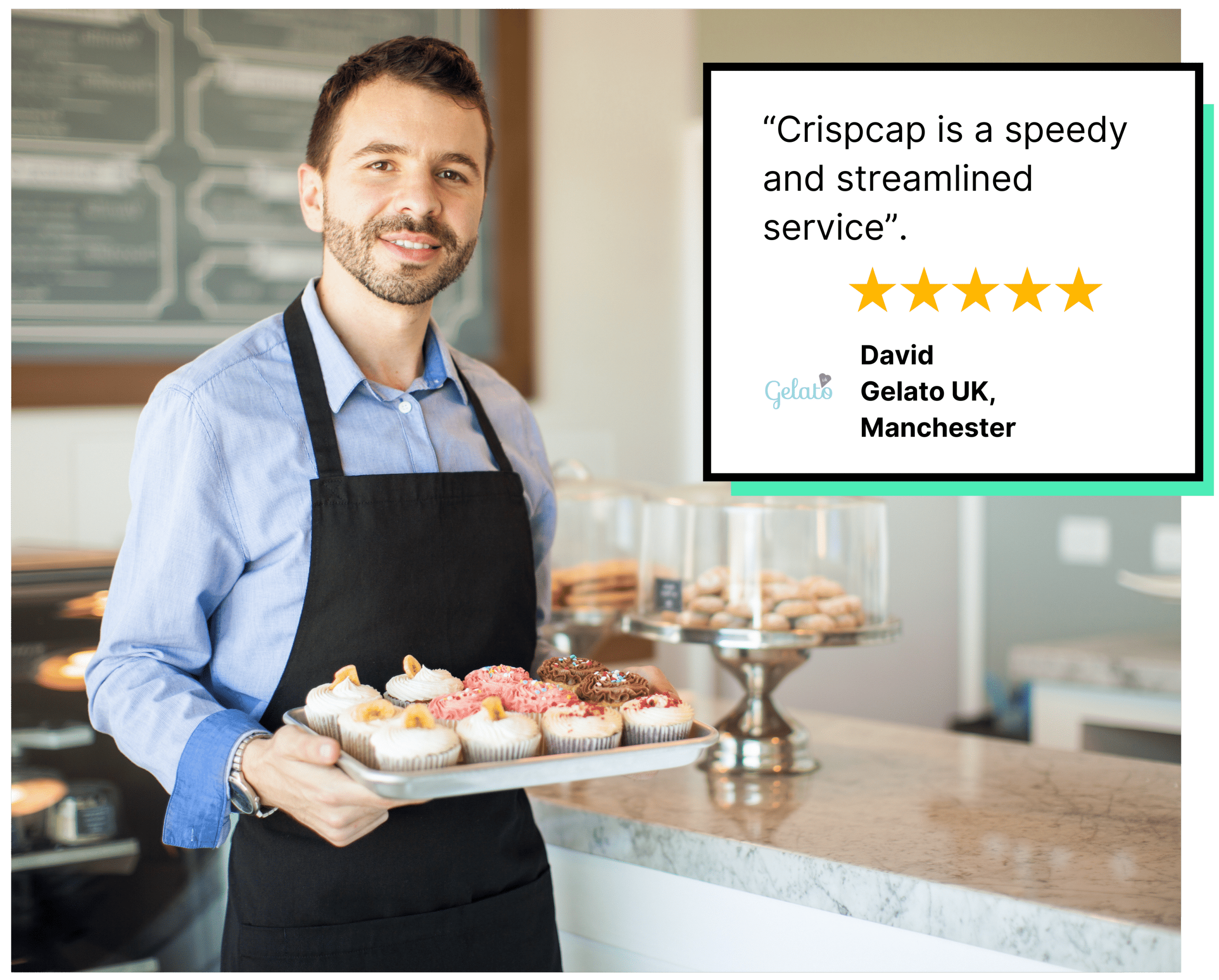

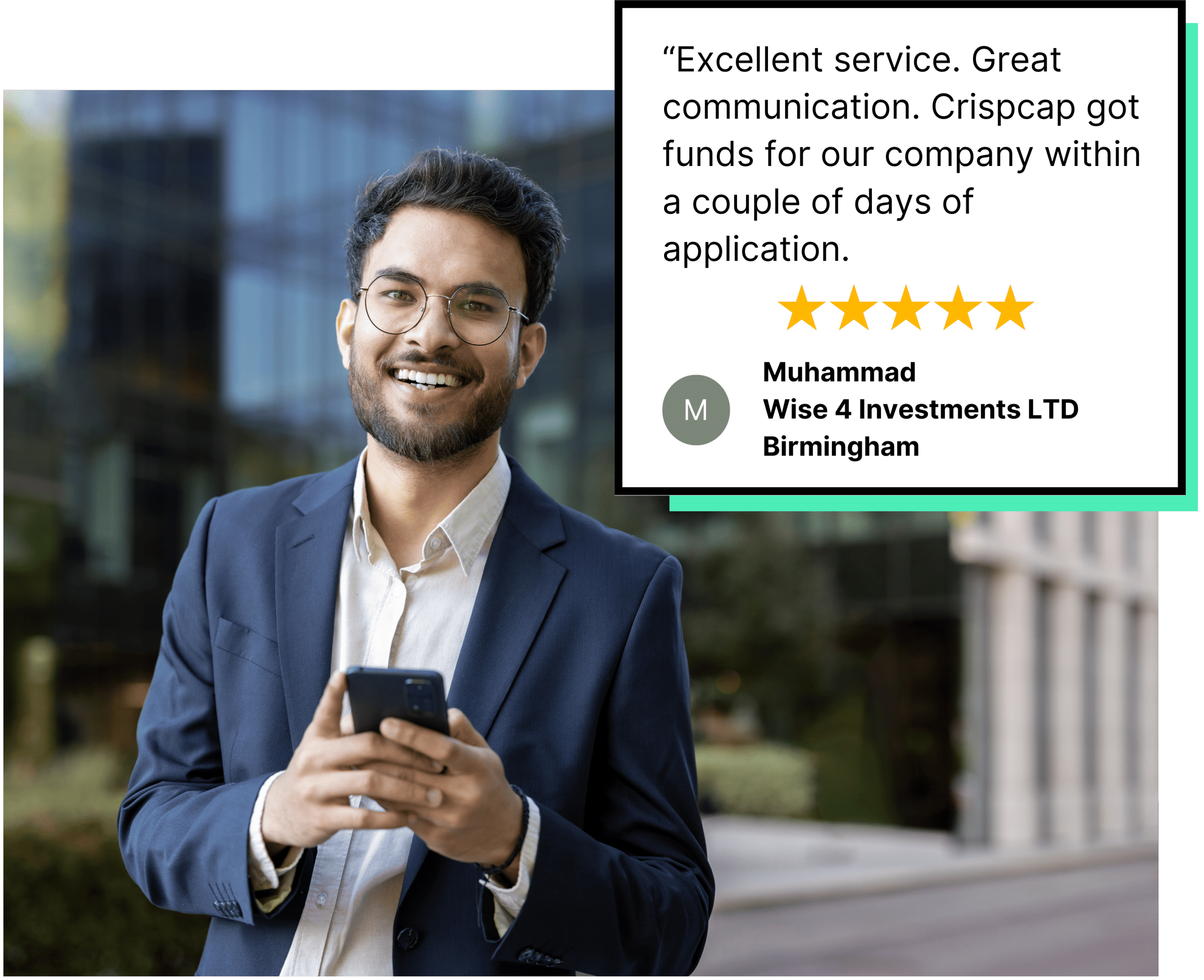

A Corporation That Cares

At Crispcap we’re passionate about arranging loans to make the lives of business owners easier. Corporation tax can be a nasty surprise at the end of an accounting year and eat into valuable profits. That’s why we’re speedy and efficient in arranging a loan that meets your terms and business needs. Tax shouldn’t stunt your growth, so let us give a helping hand to reach your potential.

Have Questions? No Problem

Have Questions? No Problem

What is the interest rate on the loan?

Interest on a loan is based on a few factors including its terms, amount, and the history of your business. The best way to get a quote is to contact us here and fill in some quick details.

Will I get approved for a loan?

We’ve worked with businesses of every size, turnover, and credit rating. Crispcap is proud to take a human-centred approach to business and look beyond financials alone. We’re flexible like that.

What loan terms can I choose from?

You can choose terms from 3-72 months! Because corporation tax bills come annually, we usually recommend repayment terms of 12 months or less.

How quick is the application process?

Only 30 seconds. Just click here

and quickly give us some details about your business to get the ball rolling. We’ll be in touch after you fill in the form.

Do you give me a credit check?

Your free quote does not involve a credit check at all. A hard credit check will only be completed once you’ve agreed with the loan amount and wish to proceed. No nasty surprises here.

Is a Corporation Tax Loan unsecured?

It is indeed. All of Crispcap’s loans are unsecured loans of a sort. That means we don’t use assets as security, but instead require a personal guarantee in case your business folds.